Startups in the trucking sector should prioritize obtaining startup-friendly insurance quotes that cater to their unique operational needs and tight budgets. These quotes should be for tailored fleet insurance with scalable policies that adapt as the business grows. Affordable truck insurance is essential for new businesses, providing both liability insurance for startups and cargo coverage plans to protect against losses during transport. Entrepreneurs must carefully evaluate these insurance options based on their cost-effectiveness and the extent of coverage they offer, ensuring alignment with the startup's size and budget. By doing so, startups can establish a solid risk management framework without unnecessary expenditure, safeguarding assets and cargo while venturing into new markets. It's crucial for startups to leverage low-cost trucking insurance options that offer robust protection, balancing fiscal responsibility with comprehensive coverage to support long-term financial stability in the competitive trucking industry.

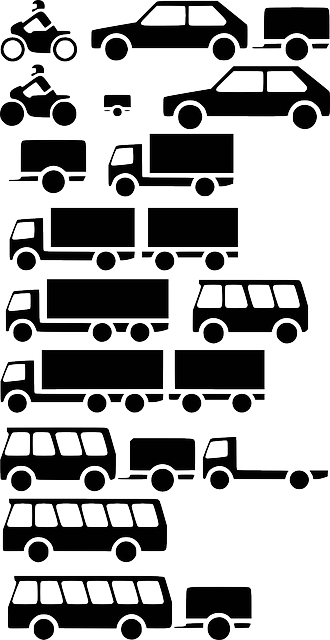

Startups face myriad financial considerations; among them, securing robust yet cost-effective insurance is paramount. This article delves into leveraging startup discounts and incentives to craft affordable truck insurance and new business coverage. We explore tailored fleet insurance options that scale with your startup’s growth, strategies for navigating liability insurance, and the essentials of cargo coverage plans. By integrating startup-friendly insurance quotes, your business can protect itself comprehensively without overspending. These insights are designed to help startups make informed decisions, ensuring they stay agile and resilient in their operations.

Maximizing Startup-Friendly Insurance Quotes: A Guide to Affordable Truck Insurance and New Business Coverage

Startups in the trucking industry can optimize their financial resources by leveraging startup-friendly insurance quotes that cater to their unique needs. These tailored fleet insurance options are designed with scalability in mind, allowing young businesses to adjust coverage as they grow. By exploring affordable truck insurance plans, startups can ensure compliance with regulations while managing expenses effectively. It’s crucial for new entrants to navigate through the various liability insurance for startups available, selecting a policy that provides adequate protection without overextending their budget. Additionally, cargo coverage plans are an essential component of comprehensive trucking insurance, safeguarding against potential losses due to damage or theft of goods in transit. Startups should consider each aspect carefully to ensure their policies align with the operational scale and financial capacity, thereby facilitating a robust risk management strategy without compromising on cost efficiency. Each quote should be scrutinized not just for its affordability but also for the breadth of coverage it offers, ensuring that both the vehicles and the cargo are adequately protected as the business ventures into new territories.

Tailored Fleet Insurance for Startups: Scalable Policies Without Compromising on Essential Protection

For startups in the transportation sector, securing startup-friendly insurance quotes that cater to their unique needs is paramount. New businesses often operate with tight budgets but cannot afford to skimp on essential protection. Tailored fleet insurance offers a solution by providing scalable policies that can grow with the startup’s expansion. These policies are designed to accommodate the varying sizes of a startup’s fleet, ensuring that as your business evolves, your coverage adapts accordingly without compromising on critical aspects such as liability insurance and cargo coverage plans. This flexibility is particularly valuable for startups looking for affordable truck insurance that can protect against unforeseen incidents while maintaining operations. Startups can benefit from low-cost trucking insurance options that offer comprehensive coverage, allowing entrepreneurs to focus on their core business activities without the fear of crippling financial losses due to accidents or cargo damage.

Incorporating new business coverage into your risk management strategy is not just about cost savings; it’s about making informed decisions. Startups must consider the long-term implications of their insurance choices, as these can significantly impact the financial health of the company. The right tailored fleet insurance policy not only offers low premiums but also provides peace of mind, knowing that your assets and liabilities are protected. As your startup’s operations evolve, rest assured that you have the option to adjust your coverage levels, ensuring that you maintain the best possible balance between coverage and cost. This adaptability is a cornerstone for startups navigating the complexities of the trucking industry, where operational stability is essential for growth and success.

Navigating Liability Insurance for Startups: Strategies for Securing Low-Cost Trucking Insurance Solutions

For startups in the trucking industry, securing affordable truck insurance that accommodates the unique needs of a growing business is paramount. New businesses often operate with tight budgets, making startup-friendly insurance quotes a top priority. To navigate this challenge effectively, startups should explore insurance providers offering tailored fleet insurance solutions designed for their specific operations. These policies are scalable, allowing startups to adjust their coverage as their fleet expands or contracts, ensuring they only pay for the protection they need at any given time. By leveraging discounts and incentives specifically crafted for new enterprises, entrepreneurs can obtain comprehensive liability insurance for startups, including cargo coverage plans, without incurring excessive costs that could strain their finances. Startups should take advantage of these cost-effective options to safeguard their operations against unforeseen events while optimizing their financial resources for other critical business areas.

In the competitive landscape of trucking, affordability and robust coverage are not mutually exclusive. Many insurance carriers recognize the importance of supporting startups by providing low-cost trucking insurance packages that don’t compromise on essential protections. These packages often include liability coverage, which is indispensable for protecting against third-party claims resulting from accidents or damages. Additionally, cargo coverage plans are available to secure the financial wellbeing of a startup in the event of lost or damaged goods during transit. By carefully comparing quotes and policies, startups can identify those that offer the most value, ensuring they are adequately protected without overspending. The key is to engage with insurance providers that understand the needs of new businesses and tailor their solutions accordingly, fostering a sustainable path forward for startups in the trucking sector.

Cargo Coverage Plans for Beginners: Ensuring Your Business Stays Protected on the Road Ahead

For startups in the trucking industry, securing startup-friendly insurance quotes is pivotal for long-term success and risk mitigation. Affordable truck insurance tailored for new ventures can provide the necessary financial protection without straining your business’s budget. These policies are designed to be scalable, allowing them to grow and adapt as your fleet expands. New businesses often face unique challenges; therefore, it’s crucial to find coverage that addresses these specific needs. Tailored fleet insurance for startups ensures that you’re not overpaying for the essential protections like liability insurance, which is a cornerstone of trustworthiness and safety in the trucking sector. By opting for cargo coverage plans, startups can safeguard their goods against loss or damage during transit, a critical aspect given the inherent risks associated with transportation. These plans are crafted to be cost-effective, ensuring that your business remains protected on the road ahead without compromising on financial prudence. As you evaluate your options for low-cost trucking insurance, consider how scalable policies can evolve with your startup’s growth, providing continuous coverage and support as you navigate the competitive landscape of the transportation industry.

In conclusion, startups in the trucking sector have a multitude of startup-friendly insurance options at their disposal, designed to provide both affordable truck insurance and new business coverage. By opting for tailored fleet insurance, startups can find scalable policies that offer essential protection without overwhelming financial commitment. Navigating liability insurance for startups is streamlined with low-cost solutions that safeguard your operations from unforeseen events. Furthermore, securing comprehensive cargo coverage plans ensures that the backbone of your business remains protected on the road ahead. Leveraging these incentives and discounts not only supports cost-effective policies but also contributes to the long-term stability and growth potential of your startup in the competitive trucking industry.