Cargo coverage plans offer businesses and individuals comprehensive security for transported goods, including liability, in-transit protection, and customs assistance. To maximize value, it's crucial to understand the fine print, review terms and conditions, and customize policies based on specific needs. Real-world case studies show that strategic bundling of cargo insurance can lead to enhanced operational efficiency, reduced costs, and improved customer satisfaction for diverse companies.

Unlocking the secrets of bundled coverage can significantly enhance your value as a business or individual shipper. This article guides you through the intricacies of cargo coverage plans, focusing on understanding their multifaceted benefits and how to make the most of them. We’ll explore strategies for customization, decipher complex terms and conditions, and present real-world case studies demonstrating the power of bundled cargo coverage in securing comprehensive protection for your goods.

Understanding Cargo Coverage Plans: Unveiling the Bundled Benefits

Cargo coverage plans offer a comprehensive suite of benefits designed to protect valuable goods during transit. These plans typically bundle various insurance options, offering enhanced security for businesses and individuals transporting merchandise. By understanding the intricacies of these coverage plans, you can make informed decisions to maximize your protection.

Each cargo coverage plan is tailored to cater to diverse shipping needs. They often include provisions for liability coverage, which shields against potential losses or damages incurred during transportation. Additionally, they may offer valuable in-transit coverage, ensuring compensation for goods lost, stolen, or damaged while en route to their destination. Bundled benefits also extend to customs and regulatory compliance assistance, simplifying the documentation process and safeguarding against legal pitfalls.

Decoding the Terms and Conditions: What's Included, What's Not?

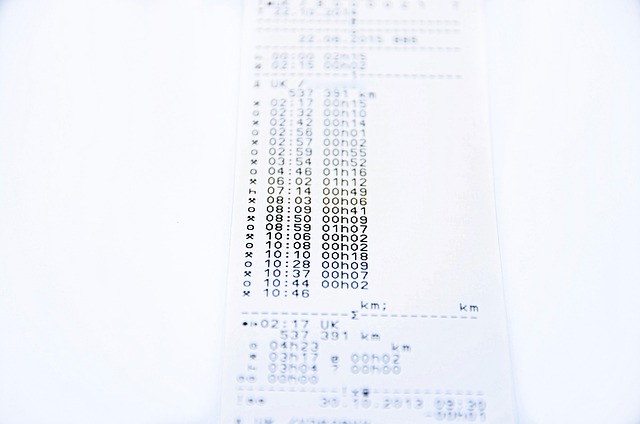

Understanding the fine print is essential when exploring bundled coverage benefits, especially in the realm of cargo coverage plans. Many companies offer comprehensive packages, but it’s crucial to decode the terms and conditions to ensure you’re getting true value for your money. Reviewing these documents will help you identify what aspects of shipping and logistics are covered and which remain uncovered.

In the intricate landscape of cargo coverage, each plan has its own set of inclusions and exclusions. Some plans may offer protection against damage during transit, while others might include liability coverage for incidents at loading or unloading points. By carefully reading through the terms, you can avoid unwelcome surprises and ensure that your valuable cargo is adequately secured, aligning with your specific shipping needs.

Strategies to Maximize Your Coverage: Customization and Flexibility

To maximize the value of your bundled coverage, understanding customization and flexibility is key. Many providers offer a range of à la carte options to tailor your policy to specific needs. For instance, if you have unique cargo requirements, consider adding specialized coverage for hazardous materials or international shipments. This ensures you’re not paying for unnecessary aspects while receiving enhanced protection for high-risk items.

Flexibility also comes into play when adjusting deductibles and limits. Higher deductibles often lead to lower premiums, but ensure you can comfortably cover the amount in case of a claim. On the other hand, increasing coverage limits can provide peace of mind, especially for valuable cargo. Regularly reviewing and updating your policy based on changing business needs will help you optimize your coverage and maintain optimal value.

Case Studies: Real-World Examples of Enhanced Value Through Bundle Coverage

In the dynamic world of insurance, understanding how cargo coverage plans can be strategically bundled is a game-changer for many businesses. Let’s explore some real-world case studies to illustrate this point. Companies often face unique challenges when it comes to protecting their goods during transit, and tailored solutions are key. For instance, consider a small e-commerce business specializing in international shipping. By bundling cargo insurance with their existing shipping partnerships, they were able to secure more favorable rates and gain access to faster claim processing. This not only enhanced their operational efficiency but also provided customers with greater peace of mind.

Another compelling example involves a logistics company managing a diverse fleet of vehicles. When they combined comprehensive vehicle insurance with maintenance packages, they reduced overall costs significantly. This bundled approach ensured that routine servicing and potential repairs were covered, preventing unexpected expenses that could disrupt their operations. These scenarios demonstrate how smartly designed cargo coverage plans can lead to substantial value for businesses, offering not just financial protection but also streamlined processes and improved customer satisfaction.

By understanding the intricacies of cargo coverage plans, decoding their terms, and employing strategies to maximize customization and flexibility, businesses can unlock significant value through bundled benefits. As illustrated in our case studies, this approach not only enhances protection but also optimizes costs. Embracing these practices ensures that companies navigate the complexities of shipping with greater confidence and financial prudence, ultimately revolutionizing their cargo coverage experiences.